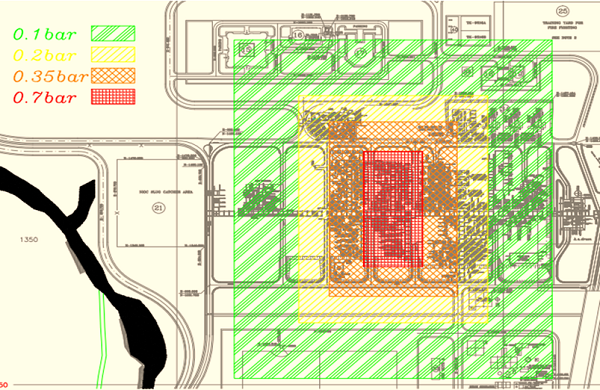

EML/PML Studies

Insurers share the risk of economical loss with the insured based on a decision-making process. This decision-making process generally involves the use of modeling to determine the extent to which a property can be damaged in the event of a hazard. Estimated Maximum Loss (EML) and Probable/Possible Maximum Loss (PML) scenarios are commonly used to understand the severe consequences of losses for a particular risk.

EML / PML studies cannot be developed precisely on the basis of theoretical knowledge about risk and exposure. Rather, these studies require a comprehensive understanding of the actual day-to-day conditions that affect the size of the loss. FPA engineers draw on their extensive experience in loss counseling to develop models that can be used to understand the extent to which insurers and reinsurers are exposed to risk. FPA engineers are able to produce EML / PML models that accurately assess risk exposure in a variety of industries to deal with catastrophic loss from fires, floods, hurricanes, earthquakes and many other factors.

Over the years, we have removed speculation from the EML / PML calculation process and instead developed an approach based on comprehensive information from insurers and their customers.

Our scope of analysis includes the following:

• Gathering sufficient information to assess the methods and processes used in a given risk.

• Collection and validation of cost data with the failure of various elements such as buildings, equipment and ...

• Assessing hazards and risk factors that cause physical damage to property and works.

• Ranking risks and hazards in order of risk rate to measure the consequences after the occurrence of a loss.

• Analyzing interdependencies to examine the impact of hazards on operations and overall property stability.

• Evaluating reinstatement options and the cost required to restore the property to pre-loss conditions.